The word “tariff” has been thrown around liberally in the past few months, and more importantly, tariffs have been implemented and paused more than a few times in the past few months. However, for the average American, or better yet, student, this economic term may still be a mystery or some kind of unknown policy that affects the global economy in unpredictable ways.

To answer the simplest question, a tariff is a tax implemented by a government on foreign goods when said items are imported. This cost is most directly paid by the company importing the goods, but can often be passed on to the consumer in the form of higher prices.

The history of tariffs in the United States begins before the 1800s, when the U.S. relied on tariffs for government funding before the income tax was established. They disappeared for a while before coming back after World War I in the form of the Smoot-Hawley Tariff Act. Created to protect American industries from foreign competition, the tariffs incited a trade war that ultimately reduced global trade. A trade war happens when tariffed countries implement reciprocal tariffs, causing domestic companies to lose foreign markets and prices to rise all over. After the second war, a number of countries, including the U.S., signed the General Agreement on Tariffs and Trade (GATT), a treaty to reduce trade barriers between countries. According to the Federal Reserve, GATT created an open environment for post-war economic growth and wealth creation.

One of the biggest reasons President Donald Trump cites for implementing tariffs is to restrengthen and bring back certain industries. This idea is called protectionism, where tariffs are implemented to make foreign goods more expensive and thus promote nationally made goods.

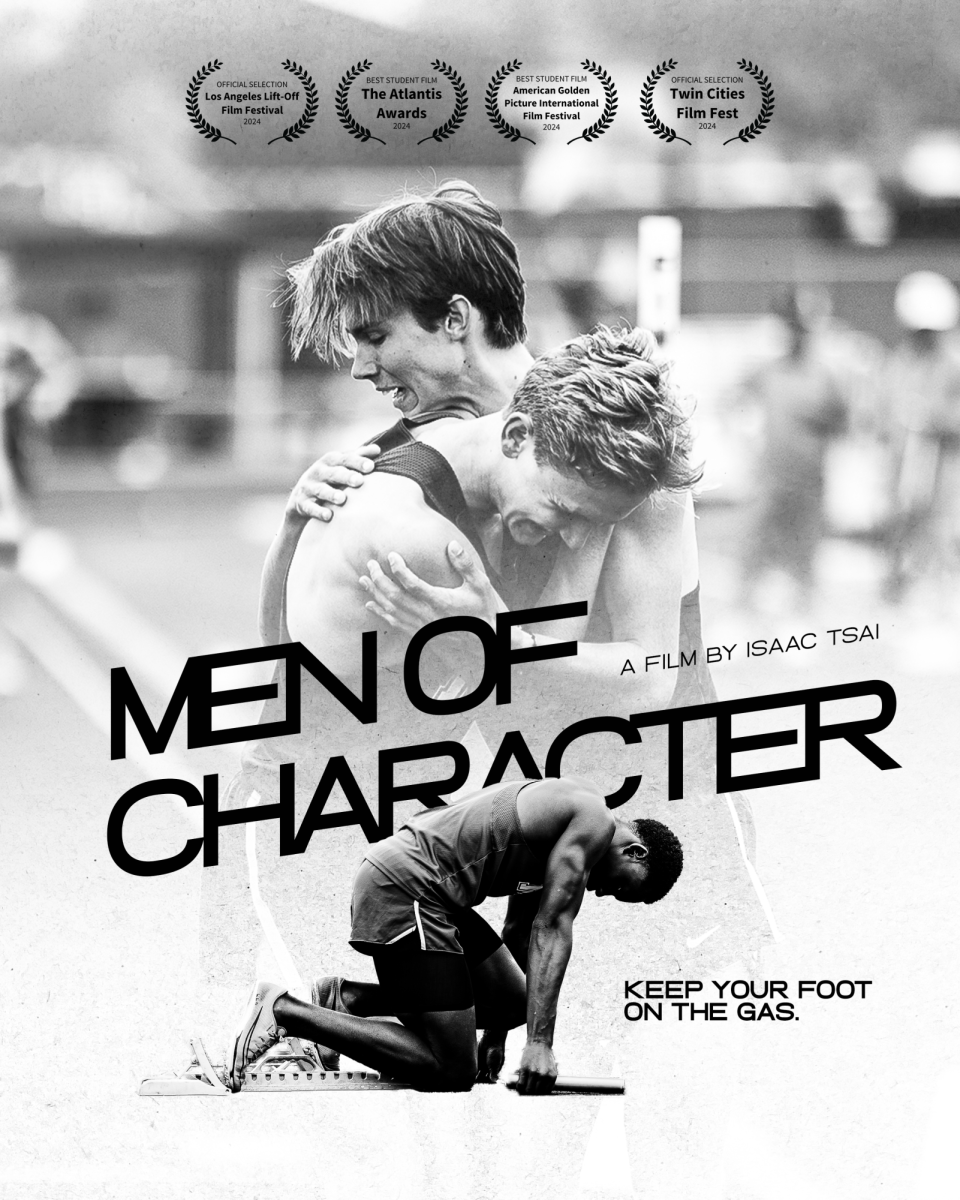

While tariffs can bring jobs and reignite industries, Aaron Oseland, social studies teacher, said, they should be applied to specific goods, and domestic policies should be implemented alongside to help develop those industries. “Classical economists would say you implement the tariffs and eventually the industry will come, but it might be decades. To build a new steel mill takes something like a decade.… And so to implement tariffs without also trying to develop those industries at the same time or slowly phasing them in, all it does is hurt us,” Oseland said.

A problem with attempting to revive certain industries, however, is that it could actually harm our economy and productivity as a nation. Today, the U.S. focuses on industries like education, finance, service and high tech, and many of the industrial jobs that Trump hopes to bring back with tariffs have actually been replaced by machines and automation. The United States’ focus and advantage in specific industries is called comparative advantage. “Not all countries have the same resources, the same environment [and] the same skills. Some countries do stuff better than others…When countries are able to focus on the thing they do best, they can then get really good at that and do it for super cheap. Then it’s cheaper for everybody around the world,” Oseland said. The loss of comparative advantage that can come about because of broad tariffs can lead to a loss of productivity.

Another reason Trump had for implementing tariffs was because of the trade deficit that the U.S. has with other countries. A trade deficit is when one country imports more than they export. However, trade deficits do not usually take into account service trading, like information, finance or accounting, which the U.S. provides a lot for other countries. Beyond that, trade deficits are not always negative. “Even if we have a trade deficit with a country, because we bought this stuff in American dollars, now this country has tons of American dollars that it can’t use in that country. What do they do with those American dollars? Invest it back into the United States. They buy stocks in companies [and] invest into financial firms. So, even if we have a trade deficit, there’s more investment in our economy, which increases productivity,” Oseland said.

While tariffs have long-term positive and negative effects, the implementation and pausing of tariffs can just lead to an unstable and uncertain economy. When the economy is stable, businesses are more likely to invest in development, which grows future wealth. “Right now, you’re seeing businesses pull back because they don’t know what will happen next. And while that won’t affect prices now directly for most of us, what it will affect is, there’ll be fewer new inventions in the future,” Oseland said.

Thus, tariffs, like many economic decisions and policies, will have national and global effects that economists can only predict for now. Whether they revive American industries or lead to a recession or even a depression, only time, Trump’s decisions, and the market’s reaction will tell.

![[DEBATES] Prestigious colleges: value or hype?](https://www.mvviewer.org/wp-content/uploads/2024/12/buildings-1200x654.png)

![[OPINION] The dark origins of TikTok's looksmaxxing trend](https://www.mvviewer.org/wp-content/uploads/2024/02/Copy-of-Copy-of-Untitled-Design-1200x675.png)