Personal Finance Classes

October 11, 2022

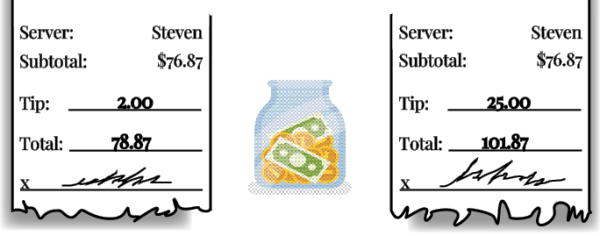

Over the last few decades, financial literacy has been a fiercely debated topic in both schools and government with most people wondering, “Should schools offer and require personal finance classes in their curriculums?”

But what exactly are personal finance classes? Personal finance classes teach skills that relate to managing individual finances, including aspects such as taxes, insurance and retirement funds. According to the Council for Economic Education (CEE), 14 states require personal finance classes at a high school level, Minnesota not included. However, support in favor of requiring personal finance classes in Minnesota is growing.

A survey at the 2022 State Fair concluded that over 90% of fairgoers believed that students should be required to take a personal finance and civics class to graduate. This is also reflected in Mounds View, where many students share the same sentiment.

Junior Sorelle Tan believes that personal finance classes are essential. “You can use it in your own life later on — you’ll have to actually apply the knowledge to your jobs and you can better manage your finances,” said Tan.

Tan isn’t the only one who values personal finance. Junior Zali Akiba would help young adults learn valuable skills. “It helps you manage your finances and helps with filing taxes later on,” said Akiba.

Generally, personal finance classes are desired in Mounds View and throughout Minnesota, but how these classes will be implemented remains a topic of hot debate. Tan believes that they should be stand-alone classes. “I think that Minnesota should mandate at least one personal finance class throughout high school,” said Tan. Akiba, however, said, “I think that [personal finance classes] should be incorporated into the economics courses we take freshman year. And, many people might not want to take the class as an elective.”

Akiba believes that schools should be more involved, and “have a CPA or accountant in the school so that students can ask them questions about their personal finances.” Tan also believes schools should promote these classes. “They should advocate for making personal finance classes necessary, which might make other schools implement them too,” said Tan.

It seems that support for these classes in school is ubiquitous, but the devil is in the details. Different opinions on the implementation and the school’s role in preparing students for adulthood leave many things up for debate. Despite this, overwhelming support will likely push Minnesota to join the 14 other states that mandate personal finance classes shortly.

![[DEBATES] Prestigious colleges: value or hype?](https://www.mvviewer.org/wp-content/uploads/2024/12/buildings-1200x654.png)

![[OPINION] The dark origins of TikTok's looksmaxxing trend](https://www.mvviewer.org/wp-content/uploads/2024/02/Copy-of-Copy-of-Untitled-Design-1200x675.png)

![[DEBATES] Prestigious colleges: value or hype?](https://www.mvviewer.org/wp-content/uploads/2024/12/buildings-600x327.png)